Why Does My Organization Need Cybersecurity Insurance and an MSP?

Editor’s note: In recognition of this October, we are publishing a series of blog posts dedicated to educating and informing you about cybersecurity practices. This is the ninth in a series of posts. Below, you can find a list of links to the rest of the series:

- What is a Pig Butchering Scam and How Do You Protect Yourself?

- 6 Conditional Access Policies You Should Turn on Now

- Tips for Running an Effective Cybersecurity Awareness Campaign

- What is Quishing and How Do You Protect Yourself?

- Early Warning Signs Your Employees Need to Look Out for and Report to IT

- My Dad Lost Thousands of Dollars in a Romance Scam. Here’s How They Work and How to Protect Yourself

- NIST Releases New Password Rules: What Does It Mean for You?

- 7 Reasons Your Organization Needs Cybersecurity Insurance

- Top 3 Cybersecurity Threats We Uncovered at GrrCon 2024

- Why Keeping a File with Passwords on Your Computer is a Terrible Idea

- How Do Passwords Get Hacked?

- What Happens When You Use the Phish Alert Button?

- Why Does Social Engineering Happen?

It’s common for organizations to ask us why they need cybersecurity insurance if they already have a managed service provider or an IT team. After all, an MSP or IT team responds to threats and ensures your systems are secure, right?

Yes, that is true. However, an MSP responds to an incident by monitoring activities and isolating incidents, whereas cybersecurity insurance responds to incidents by covering investigation and recovery costs. Having a managed service provider doesn’t protect you against liability in the event of a security incident.

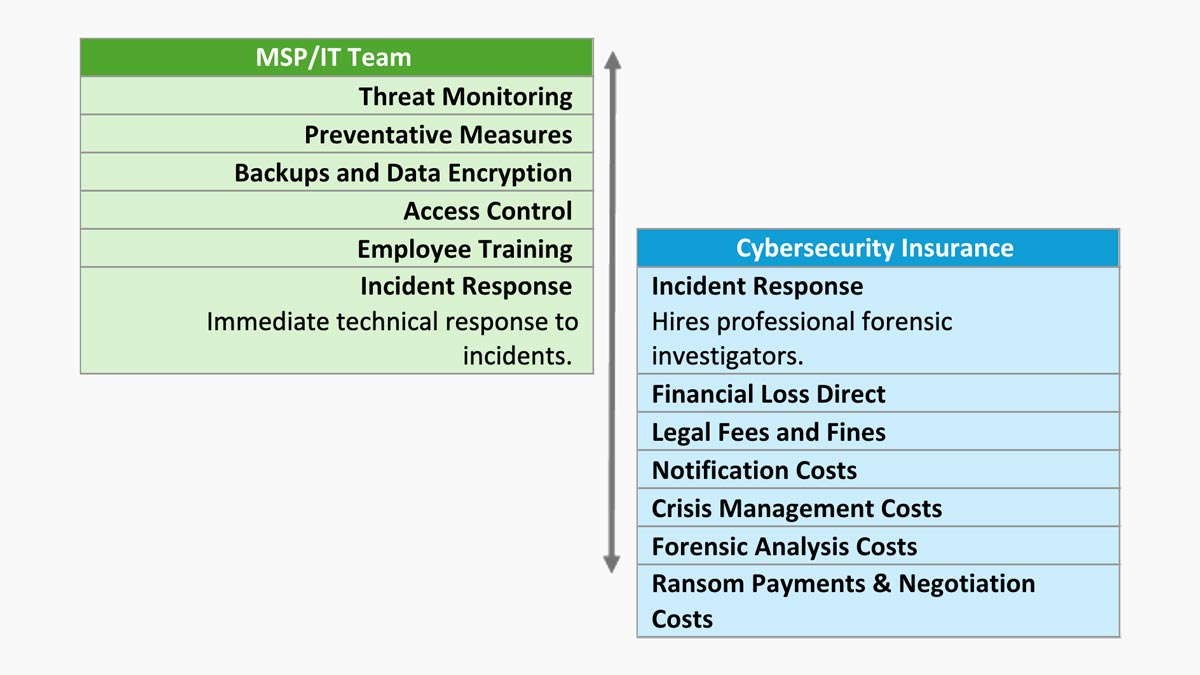

The Role of MSPs/IT Teams vs. Cybersecurity Insurance

MSPs and IT teams focus on prevention, detection and response to cyberthreats. Here’s a breakdown of their responsibilities:

MSP/IT Team Responsibilities:

- Threat monitoring: Continuous surveillance to identify potential threats.

- Preventative measures: Implementing firewalls, antivirus software and other security tools.

- Backups and data encryption: Ensuring data is backed up and encrypted to prevent unauthorized access.

- Access control: Managing who has access to what within the organization.

- Employee training: Educating staff on best practices to avoid phishing and other cyberthreats.

- Preliminary incident response: Identifying and containing the attack, performing initial investigations to gather enough information to determine if the event warrants involving insurance.

Cybersecurity Insurance Covers:

- Incident response: Covering the costs of investigating at a forensic level.

- Financial loss direct: Reimbursing for financial losses directly resulting from an attack.

- Legal fees and fines: Covering costs related to legal battles and regulatory fines.

- Notification costs: Paying for the expenses associated with notifying affected parties.

- Crisis management costs: Managing PR and reputation repair efforts post-attack.

- Forensic analysis costs: Investigating how the breach occurred and preventing future incidents.

- Ransom payments and negotiation costs: Covering costs related to ransom demands and hiring professional negotiators.

Cybersecurity Insurance is Like Any Other Insurance

In your home, you most likely have smoke alarms and a fire extinguisher to help you detect and respond to fires. But you likely also have insurance on the home. You need that insurance for catastrophic events, like if the whole house were to be destroyed by a fire.

Similarly, you want an MSP or IT team focused on detecting and responding to cybersecurity threats but should still have cybersecurity insurance when a catastrophic event burns the business down.

It’s important to note you shouldn’t replace security measures with cybersecurity insurance. They should complement one another as part of your risk management plan.

MSPs and IT teams can mitigate the risks of cyberattacks, but their capabilities have limits.

Consider Third-party Coverage

Your cybersecurity insurance policy should include third-party coverage for the benefit of someone other than you, the policyholder.

Just like with auto insurance, if your policy includes third-party coverage, you will be covered if someone makes a claim against you for damages in an accident you caused.

With cybersecurity insurance, if your IT systems are compromised and used to attack your customers, vendors or partners, third-party coverage covers you if someone claims damages.

Countering the “High Premium” Argument

Maybe you feel that cybersecurity insurance premiums are too high. However, you should consider the potential costs of a cyberattack without insurance:

- Financial devastation: Legal fees, regulatory fines and recovery costs can far exceed the annual premium. A forensic investigation alone can be a minimum of $500 per hour for a 20-hour investigation.

- Reputation damage: The cost to rebuild a damaged reputation and regain customer trust can be enormous.

- Operational downtime: While your IT team or MSP can often get you back up and running quickly, sometimes in less than a day, ongoing legal investigations can delay full recovery and hinder business operations, making the cost of downtime even higher.

Investing in cybersecurity insurance is a proactive step to mitigate these risks and protect your organization from potentially catastrophic financial losses.

Preparing for a Cybersecurity Insurance Policy

Cyberattacks can significantly impact your organization, from a hit to your reputation to the loss of revenue.

To qualify for cybersecurity insurance, you’ll need to submit to a security audit by the insurance company. The results will determine what types of coverage will be provided to you, as well as how much the premiums will cost.

Your IT team or MSP can help you prepare for the security audit by implementing these three common security practices.

Need a Security Assessment?

If you are looking to apply for a cybersecurity insurance policy, contact us here so we can help you improve your security measures.

Did you like this blog? You can subscribe to our newsletter to receive a weekly email with our latest blog posts.